MAKING A SUCCESS OF YOUR RE-INVESTMENT THROUGH A CONTRIBUTION-ASSET DEAL

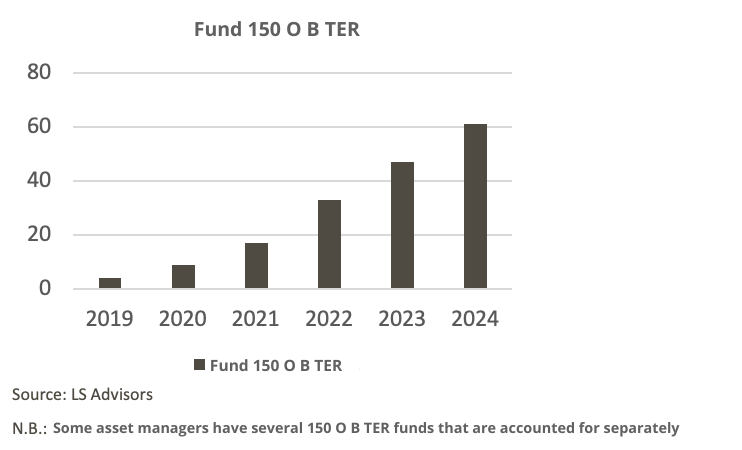

( 150 0B TER )

The transfer of shares to a new holding company created for the purpose, in order to benefit from a tax deferral on capital gains.

In this case, the gains generated by the sale of the company, which takes place at a later date, must be reinvested in order to benefit from this tax deferral (Article 150-0 B Ter of the CGI).

To do so, you need to reinvest 60% of the proceeds from the sale of your company, either directly or via funds eligible for the scheme, within two years of the sale.

A growing number of funds meet the eligibility criteria, but not all are created equal.

A long-term investment requires a reliable partner.

It is essential to choose asset managers capable of navigating market cycles, with stable teams, proven processes and transparent track records.

At LS Advisors, we work exclusively with managers known for their discipline, governance and resilience.

The end of the zero-rate era has changed how funds generate returns.

It is crucial to analyze:

the actual leverage used,

the real drivers of performance (growth, multiple, operational value creation),

and the consistency between the stated strategy and the executed one.

Our expertise helps investors avoid unpleasant surprises.

Dispersion in private equity performance has increased significantly — between managers, strategies, and especially vintages.

Some years offer much better entry opportunities than others.

Identifying the right timing requires in-depth market and cycle analysis.

LS Advisors performs this ex-ante work to guide clients toward the most favourable vintages.

Diversification is crucial, especially with illiquid long-term assets like private equity.

It helps:

reduce capital loss risk,

smooth returns,

mitigate defaults or poor performance,

and limit liquidity risk.

Depending on portfolio size, 4 to 6 funds is generally optimal — in line with institutional practice.

We help clients build coherent sector and geographic diversification.

Private equity is inherently illiquid.

Commercial brochures often present optimistic holding periods that exclude possible extensions.

In some situations, actual liquidity may exceed the planned duration (difficult disposals, manager bankruptcy, appointment of a liquidator…).

You must know how to:

properly interpret prospectuses,

assess the maximum potential duration,

integrate different exit scenarios.

LS Advisors supports its clients in analyzing real—not theoretical—liquidity.

The principle of private equity is that shares are not listed on an organized market. The sale of each shareholding is therefore dealt with on a case-by-case basis, which makes the sale process relatively lengthy, and the investor cannot, as on the stock market, sell his shares in a matter of seconds and immediately receive the cash from the sale.

Products are often presented on sales sheets with a holding period that does not include possible extension periods, whereas a private equity investment should be considered as being for the entire period, i.e. 12 years in the longest cases! It is therefore imperative to be accompanied by a specialist who can identify the true maximum duration of your investment.

What's more, in certain specific cases (difficulty in disposing of a major fund asset, for example, or the appointment of a liquidator in the event of manager bankruptcy or embezzlement), liquidity may be higher than that stipulated in the prospectus, in order to protect unitholders.

But there are also other important factors for which our customers often need assistance:

Your LS Advisors partner: