A digital solution designed for professionals

Lassie Private Equity

In an ever-expanding financial environment, LS Advisors leverages technology to offer its clients comprehensive support throughout the entire investment process, from design to management and monitoring of their private equity allocations. Not to mention the option of directly placing products in contracts managed by our management company, providing our clients with significant time savings and diversification.

A platform for easy access to the world of unlisted securities

LASSIE PE is our innovative internal digital platform that gives professional clients access to global private equity opportunities. Thanks to a structured and rigorous approach, we enable you to invest in the best private equity funds, with comprehensive, digital support from selection to subscription.

Discover the Lassie digital platform

Please don't hesitate to contact us if you would like a demonstration! We can set up a free trial account for you on the Lassie platform.

Why invest in private equity?

Private equity significantly outperforms public markets over the long term. For example, KKR funds have posted a gross internal rate of return of 25.5% since 1976, compared to 12.2% for the S&P 500, a difference of more than 13 points in annual performance (Financial Times, 2025). At the same time, the number of privately financed companies continues to grow, while the number of publicly traded companies is declining (halved in 20 years) — reinforcing the strategic nature of private equity investments via LASSIE PE.

A digital solution designed for professionals

A rigorous and international selection of funds

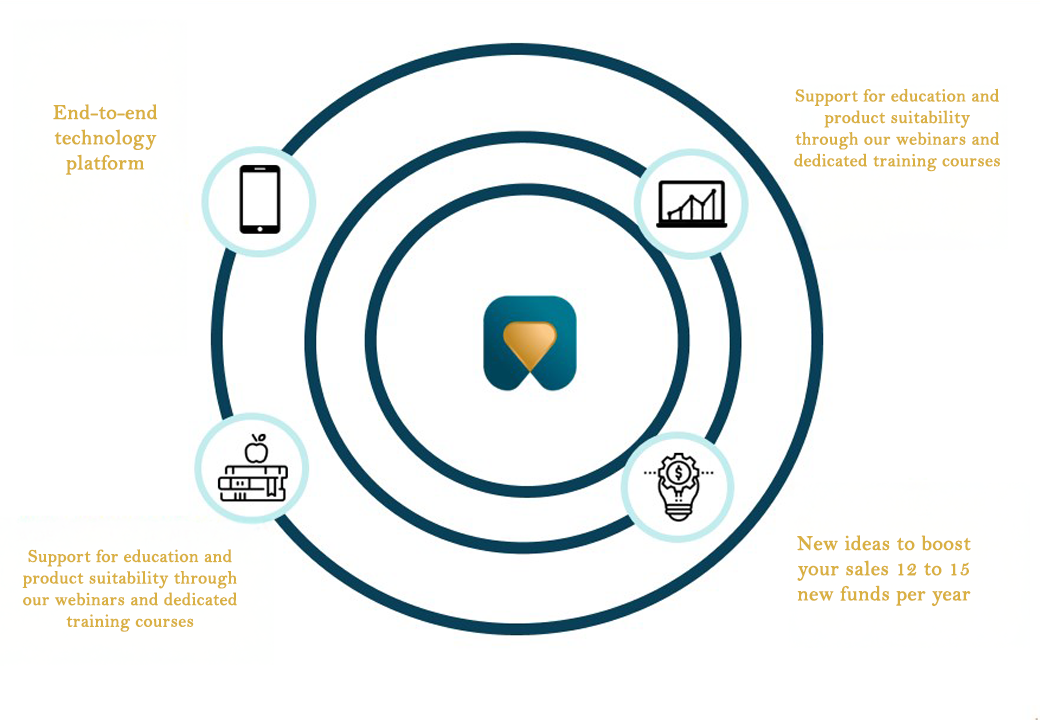

LASSIE PE is much more than a tool for accessing private markets. It is an end-to-end platform that integrates:

Our methodology is based on a dual top-down and bottom-up approach, combining long-term macroeconomic allocation with careful selection of the best international managers.

Each year, we analyze a universe of more than 3,800 funds and select only 12 to 15 of them, following a rigorous due diligence process conducted in collaboration with our partners.

The selection criteria include:

A diversified and balanced allocation

Each year, the LASSIE PE fund portfolio is structured around five main areas of diversification:

Unlisted investment opportunities

With nearly two decades of expertise in alternative asset advisory and a global presence, LS Advisors gives you access to a digital private equity platform that is rigorous, intuitive, and completely open. Thanks to international sourcing, a proven selection method, and a simplified interface, LASSIE PE supports you at every stage of your investment in private markets.

Selection and execution process

The LASSIE PE platform is based on a rigorous and selective fund selection method, developed in partnership and structured in three stages:

We apply a holistic top-down and bottom-up approach, combining:

Each year, 12 to 15 funds are selected based on an advanced diversification strategy along five axes:

strategy, geography, size, sector, timing.

Execution is carried out directly with the selected funds or via our partner insurers, without any flows passing through LS Advisors, ensuring total security and transparency.

Private Equity Support and Training

Because unlisted companies require specific support, LS Advisors offers its distribution partners training courses dedicated to private equity, with different levels of expertise.

Our teams help you to:

Our training courses cover topics such as:

To book a training session, click here.